Announcements , Technical

October 26, 2022

2022-23 October Federal Budget SMSF Recap

On the 25th October 2022 the Labour Government handed out its first Federal Budget outlining how it aims to deal with the ever-changing economic climate.With regards to the SMSF sector, it was a relatively quiet budget, however the announcements that were made will have a very positive benefit on the sector at large.Three Year SMSF Audits Policy Cancelled The previously announced change of a three-year audit cycle was declared to no longer be proceeding. Since its original announcement, this proposed changed received major criticism, particularly from the SMSF sector.Downsizer Contribution Eligibility Age Reduced From 1 July 2022, members who are 60 years or older are eligible to make a downsizer contribution of up to $300,000 upon the sale of their main residence.However, it was announced the eligibility age will further be reduced to 55 years old.The change will provide more members the opportunity to further contribute into super without needing to rely on their concessional or non-concessional contribution caps.Residency Requirement Improvements For a member to be deemed an eligible member under s.17A of the SIS Act, they must meet the residency requirements. These include:Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

With regards to the SMSF sector, it was a relatively quiet budget, however the announcements that were made will have a very positive benefit on the sector at large.Three Year SMSF Audits Policy Cancelled The previously announced change of a three-year audit cycle was declared to no longer be proceeding. Since its original announcement, this proposed changed received major criticism, particularly from the SMSF sector.Downsizer Contribution Eligibility Age Reduced From 1 July 2022, members who are 60 years or older are eligible to make a downsizer contribution of up to $300,000 upon the sale of their main residence.However, it was announced the eligibility age will further be reduced to 55 years old.The change will provide more members the opportunity to further contribute into super without needing to rely on their concessional or non-concessional contribution caps.Residency Requirement Improvements For a member to be deemed an eligible member under s.17A of the SIS Act, they must meet the residency requirements. These include:Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

Three Year SMSF Audits Policy Cancelled The previously announced change of a three-year audit cycle was declared to no longer be proceeding. Since its original announcement, this proposed changed received major criticism, particularly from the SMSF sector.Downsizer Contribution Eligibility Age Reduced From 1 July 2022, members who are 60 years or older are eligible to make a downsizer contribution of up to $300,000 upon the sale of their main residence.However, it was announced the eligibility age will further be reduced to 55 years old.The change will provide more members the opportunity to further contribute into super without needing to rely on their concessional or non-concessional contribution caps.Residency Requirement Improvements For a member to be deemed an eligible member under s.17A of the SIS Act, they must meet the residency requirements. These include:Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

The previously announced change of a three-year audit cycle was declared to no longer be proceeding. Since its original announcement, this proposed changed received major criticism, particularly from the SMSF sector.Downsizer Contribution Eligibility Age Reduced From 1 July 2022, members who are 60 years or older are eligible to make a downsizer contribution of up to $300,000 upon the sale of their main residence.However, it was announced the eligibility age will further be reduced to 55 years old.The change will provide more members the opportunity to further contribute into super without needing to rely on their concessional or non-concessional contribution caps.Residency Requirement Improvements For a member to be deemed an eligible member under s.17A of the SIS Act, they must meet the residency requirements. These include:Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

Downsizer Contribution Eligibility Age Reduced From 1 July 2022, members who are 60 years or older are eligible to make a downsizer contribution of up to $300,000 upon the sale of their main residence.However, it was announced the eligibility age will further be reduced to 55 years old.The change will provide more members the opportunity to further contribute into super without needing to rely on their concessional or non-concessional contribution caps.Residency Requirement Improvements For a member to be deemed an eligible member under s.17A of the SIS Act, they must meet the residency requirements. These include:Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

From 1 July 2022, members who are 60 years or older are eligible to make a downsizer contribution of up to $300,000 upon the sale of their main residence.However, it was announced the eligibility age will further be reduced to 55 years old.The change will provide more members the opportunity to further contribute into super without needing to rely on their concessional or non-concessional contribution caps.Residency Requirement Improvements For a member to be deemed an eligible member under s.17A of the SIS Act, they must meet the residency requirements. These include:Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

However, it was announced the eligibility age will further be reduced to 55 years old.The change will provide more members the opportunity to further contribute into super without needing to rely on their concessional or non-concessional contribution caps.Residency Requirement Improvements For a member to be deemed an eligible member under s.17A of the SIS Act, they must meet the residency requirements. These include:Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

The change will provide more members the opportunity to further contribute into super without needing to rely on their concessional or non-concessional contribution caps.Residency Requirement Improvements For a member to be deemed an eligible member under s.17A of the SIS Act, they must meet the residency requirements. These include:Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

Residency Requirement Improvements For a member to be deemed an eligible member under s.17A of the SIS Act, they must meet the residency requirements. These include:Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

For a member to be deemed an eligible member under s.17A of the SIS Act, they must meet the residency requirements. These include:Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

Establishment Test – The SMSF was established in Australia, or at least one of the SMSF’s assets must be located in AustraliaCentral Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

Central Management & Control Test – The central management and control of the SMSF is ordinarily undertaken in Australia; andThe Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

The Active Member Test – At least 50% of the SMSF Membership must be in Australia, measured by market valueIn the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

In the 2022 Federal budget it was announced the following changes would be made to these requirements:The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

The central management and control test “safe harbour” would be extended from two years to five years. This allows a member to be deemed temporarily overseas for up to five years while still meeting the central management and control testThe removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

The removal of the active member test. This will allow members who are overseas the ability to contribute into their SMSF which would previously be difficult without failing the active member testAlthough these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

Although these changes were proposed to take effect from 1 July 2022, this never eventuated.The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

The Labour government has confirmed both measures will go ahead, however a set date has not been confirmed.Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

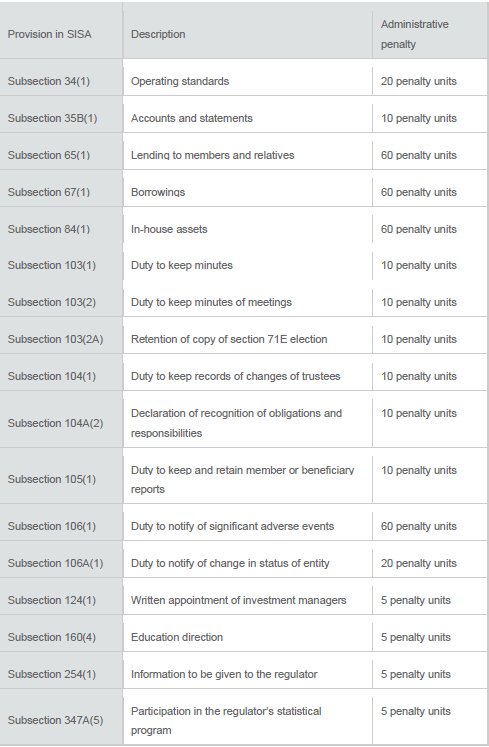

Penalty Unit Rate Increased From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

From 1 January 2023 the Commonwealth penalty unit will increase from $222 to $275. This amount is indexed every three years in line with CPI.Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

Where SMSF trustees breach the SIS Act/Regulations and therefore receive an administrative penalty from the ATO, it should be noted the overall fee required to be paid will now increase based on the rise per penalty unit.Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

Fees are charged to either each individual trustee or where the SMSF has a corporate trustee it will be charged to the company (therefore a strong argument for SMSF’s to appoint a corporate trustee).Below are the current administrative penalties:

Below are the current administrative penalties:

Related Posts

- Downsizer contributions; the scheme helping retirees bolster their super balance ( April 13, 2022 )

- Conditions of Release ( February 28, 2022 )

- The age-old debate; Corporate or Individual trustees ( February 4, 2022 )

- Pink Diamonds: Collectable or Precious Metal? ( November 15, 2021 )

- Let’s Talk Property Valuations ( September 10, 2021 )

- How to invest in Cryptocurrency for your SMSF – The right way ( August 16, 2021 )

- How to get SuperStream ready! ( August 6, 2021 )

- 6 Member SMSF – Is it Worth it? ( July 19, 2021 )