Technical

February 28, 2022

Conditions of Release

There comes a point in time where a member of an SMSF wants to access their hard-earned retirement savings.

Whether or not you can withdraw money from your SMSF is dependent on your preservation status and whether you have met a condition of release.

Withdrawing money from your SMSF without meeting a condition of release can result in harsh penalties from the ATO; therefore, trustees must be aware when members are eligible to withdraw.

Before understanding what a condition of a release is, it is crucial to understand what a preserved and non-preserved benefit is.

Until you meet a condition of release, your benefits are generally classified as preserved.

Your benefits are classified as preserved until you meet a condition of release. Once a condition has been met, the member can begin to access their super.

When a member reaches preservation age, you may access some of your preserved benefits (via a transition to retirement income stream).

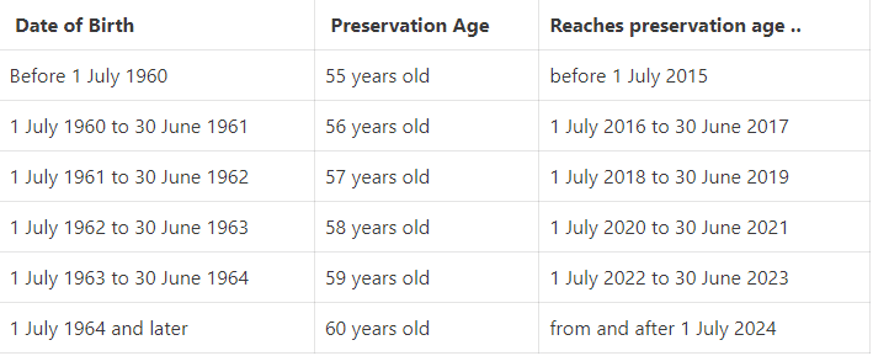

Your preservation age depends on the year you were born, ranging from 55 years to 60 years of age. The below table illustrates the preservation ages:

Unrestricted non-preserved benefits are attained when a member satisfies a condition of release with a nil cashing restriction.

In simple terms, a cashing restriction limits the amount of preserved benefits a member can access. On the other hand, a nil cashing restriction means the member has full access to all benefits (as all preserved benefits become unrestricted non-preserved).

The following are the most common conditions of releases:

Retirement (before turning 60) – nil cashing restriction

If you are under age 60 and have met your preservation age and never intend to be gainfully employed in the future.

For example, John is 58 and has recently ceased employment as a plumber and has no intention of becoming gainfully employed in the future.

Gainful employment relates to an individual working a minimum of 10 hours per week.

Therefore, John needs to cease an arrangement whereby he was working over 10 hours per week in order to satisfy this condition of release.

Alternatively, John would be able to return working in a capacity of less than 10 hours per week and in this case would still be considered retired.

Ceasing gainful employment (after age 60) – nil cashing restriction

Once you have reached age 60, if you cease an employment arrangement you satisfy a condition of release with a nil cashing restriction. This means your benefits become unrestricted non-preserved, meaning you can commence an account-based pension or withdraw lump sums.

If later you return to gainful employment, your newly accumulated benefits from that point will be preserved benefits until you satisfy another condition of release.

For example, Julie is 62 years old and works approximately 20 hours per week at two separate accounting firms. She decides to resign from one of the firms but continues her employment arrangement with the other firm.

As she has ceased an employment arrangement after turning 60, she can access all her preserved benefits accumulated up until that point.

Turning 65 – nil cashing restriction

Regardless of your employment status, once turning 65 years of age, you have satisfied a condition of release with a nil cashing restriction.

All preserved benefits will become unrestricted non-preserved, giving you the freedom to withdraw benefits in multiple forms (e.g. income stream, lump sum).

Permanent Incapacity – nil cashing restriction

If a member was to cease working and you’re satisfied that the member is unlikely, due to illness, to engage in gainful employment for which they are reasonably qualified by education, training, or experience, they can cash their preserved benefits.

To cash these benefits, however, the trustee must obtain medical evidence to prove that they can no longer continue employment due to their permanent incapacity.

To certify this, the trustees must obtain medical certificates from at least two qualified medical practitioners that states why the member can not work again.

They also need to define which state of permanent incapacity the member is subject to.

Temporary Incapacity – cashing restriction

Similar to permanent incapacity, when you suffer from an illness that has temporarily caused you to cease gainful employment, you may access some of your benefits.

You must also obtain two medical certificates demonstrating why they had to temporarily cease gainful employment.

This benefit must be paid as an income stream and cannot be commuted to a lump sum.

It’s not essential for the members employment arrangement to cease permanently but as long it has ceased for a period, they may access their benefits for the period of the time they weren’t working.

The amount that the member can access cannot exceed the maximum gain or reward that the member was receiving from their employment before they became ill or injured.

Terminal Medical Condition – nil cashing restriction

If a member has a terminal medical condition, they may access the balance of their SMSF as a tax-free lump sum payment (regardless of their age).

The member must obtain certification from two medical professionals that their condition will likely result in death in the next 24 months.

At least one of these medical professionals must be a specialist in an area that relates to the illness or injury the member has suffered.

The certification from the two medical professionals must state that the terminal medical condition existed either:

> at the time of the payment; or

> within 90 days of receiving the payment

Compassionate Grounds – cashing restriction

Preserved benefits may be released from your SMSF if a member doesn’t have the financial ability to cover an expense.

Examples of expenses that could fall under this include:

> medical treatment and medical transport for you or your dependant

> making a payment on a home loan or council rates so you don’t lose your home

> modifying your home or vehicle to accommodate your or your dependant’s severe disability

> palliative care for you or your dependant

> expenses associated with the death, funeral or burial of your dependant.

To access benefits on compassionate grounds, an application needs to be approved by the ATO. Refer here for further information on the application process.

Death– nil cashing restriction

Upon death, a members benefits become unrestricted non-preserved and must be paid.

The ultimate responsibility falls on the trustee(s) of the SMSF who need to follow the provisions of the trust deed to deal with the deceased benefits.

If the member had either a binding death benefit nomination or a reversionary income stream in place, this would need to be followed by the trustees.

If both are in place at the one time and nominate different beneficiaries, the trustees will need to refer to the provisions of the trust deed to determine which takes precedence.

Severe Financial Hardship – cashing restriction

Two essential requirements need to be met to satisfy severe financial hardship:

The member cannot meet reasonable living expenses

The member had to have received income support from the government for 26 weeks.

If both requirements are satisfied, the member can access their benefits and make a lump sum from the fund. The payment must be between $1,000 and $10,000, however, if the members balance is less than $1,000 they can withdraw all of their remaining balance.

You do not need to apply to the ATO for this condition of release, however, you may need to provide your auditor with the evidence to confirm the hardship

If you have any questions, please do not hesitate to get in contact with our team on (03) 5226 3599 to discuss.

Related Posts

- 2022-23 October Federal Budget SMSF Recap ( October 26, 2022 )

- Downsizer contributions; the scheme helping retirees bolster their super balance ( April 13, 2022 )

- The age-old debate; Corporate or Individual trustees ( February 4, 2022 )

- Pink Diamonds: Collectable or Precious Metal? ( November 15, 2021 )

- Let’s Talk Property Valuations ( September 10, 2021 )

- How to invest in Cryptocurrency for your SMSF – The right way ( August 16, 2021 )

- How to get SuperStream ready! ( August 6, 2021 )

- 6 Member SMSF – Is it Worth it? ( July 19, 2021 )