Technical

October 3, 2018

Actuarial Changes Made Simple – Everything you need to know

Continuing on with the trend of increased complexity, the SMSF sector has seen more changes to legislation, this time with regards to the calculation of its exempt current pension income (ECPI). These changes are already in effect and apply for all 2018 FY returns.

What are the Changes?

TRIS’s no longer eligible to claim ECPI

Historically, exempt current pension income (ECPI) could be claimed for account based pensions (ABPs) and transition to retirement pensions (TRISs) in the same manner in that assets supporting these types of pensions would be eligible to claim ECPI, which therefore resulted in part or all of the fund’s income being considered tax free.

However, for the 2018 FY and beyond, a TRIS can either be ‘in-retirement phase’ or “non-retirement phase’. Any TRIS that is in non-retirement phase will be taxed in the same manner as a members accumulation account (at 15%), where as a TRIS in retirement phase will continue to be eligible to claim ECPI.

A TRIS will be a non-retirement phase income stream where the member has met preservation age, but not yet satisfied a condition of release. A TRIS will automatically convert from non-retirement phase to retirement phase once the member satisfies a condition of release or when they attain age 65.

A retirement phase TRIS has similar traits to an ABP in that it:

Has no 10% maximum payment limit

Can claim an ECPI exemption, and

Counts towards a members transfer balance cap

Where a member would like to convert a retirement phase TRIS to an ABP, specific pension documentation will need to be prepared in order to facilitate the change. The retirement phase TRIS MUST be commuted back to accumulation, to which a new ABP will then be commenced.

At this stage a number of professional bodies are making a submission to the ATO and treasury to help rectify this commutation issue.

Deemed Segregation

For 2017 FY returns and earlier, a fund that was in 100% pension phase for part of a financial year or had a pension and an accumulation balance at the same time during the year was required to obtain an actuarial certificate on the basis that the fund assets were unsegregated for the entire year. Furthermore, the obtained actuarial percentage would be applied to the fund’s income for the entire financial year.

In the 2018 FY and beyond, where a fund obtains an actuarial certificate, the actuarial percentage will only be applied to income for the period that the fund had unsegregated assets (i.e. the period where the fund had both a pension and an accumulation balance). For periods where a fund is deemed to be segregated (i.e. the fund is in 100% pension phase), the fund will be eligible to claim a 100% exemption on all income generated in the relevant period.

In order to calculate the ECPI for a given financial year, you will now need to:

Calculate which dates the fund is deemed segregated and unsegregated

Remember a fund can move between segregated and unsegregated multiple times during the year

Once you are aware of all of the relevant periods for a given financial year, you then need to allocate all of the fund’s income to a specific period

Allocation of income should be allocated to a period based on the date the income was earned (i.e. the accrual date)

All income that was earned while the fund was segregated will have a 100% ECPI exemption (meaning it is all tax free)

All income that was earned while the fund was unsegregated will need to have the fund’s actuarial percentage applied to it in order to ascertain what is taxable and tax free

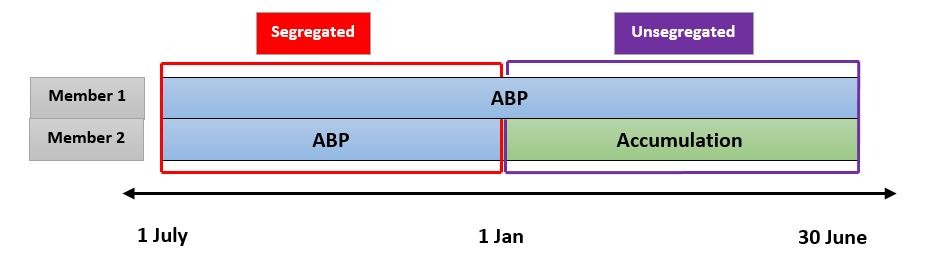

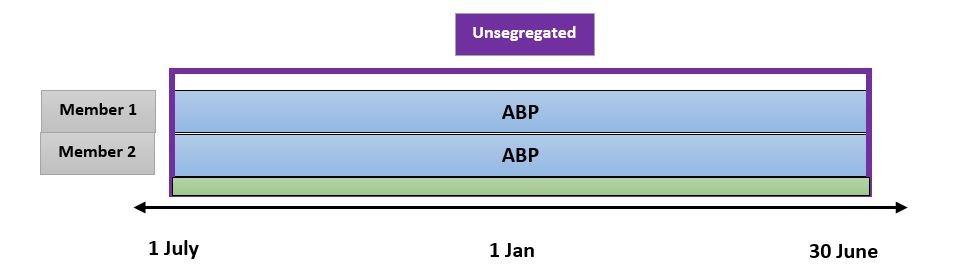

The below example illustrates how will be structured where it has a segregated and unsegregated period:

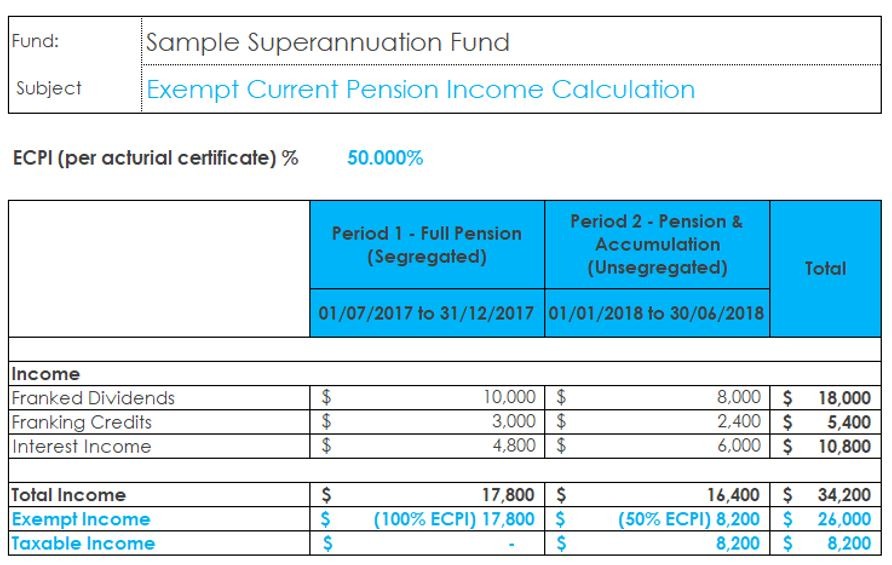

If for example the fund’s actuarial percentage is 50%, this percentage will only be applied to income earned in the period the fund was considered unsegregated (i.e. from 1 Jan to 30 June). From 1 July to 31 December, the fund will be considered segregated, which will therefore allow 100% ECPI to be claimed on any income earned during that period.

This differs to what would have been completed in prior years, in that the 50% actuarial percentage would be applied to the entire financial years income as the fund was deemed unsegregated for the full financial year.

The below example illustrates how the fund’s ECPI will be calculated using the new method:

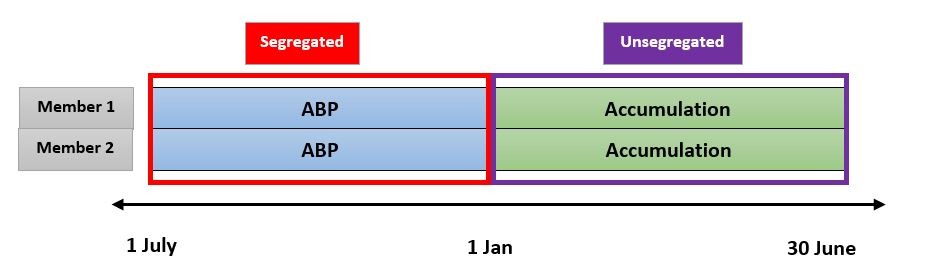

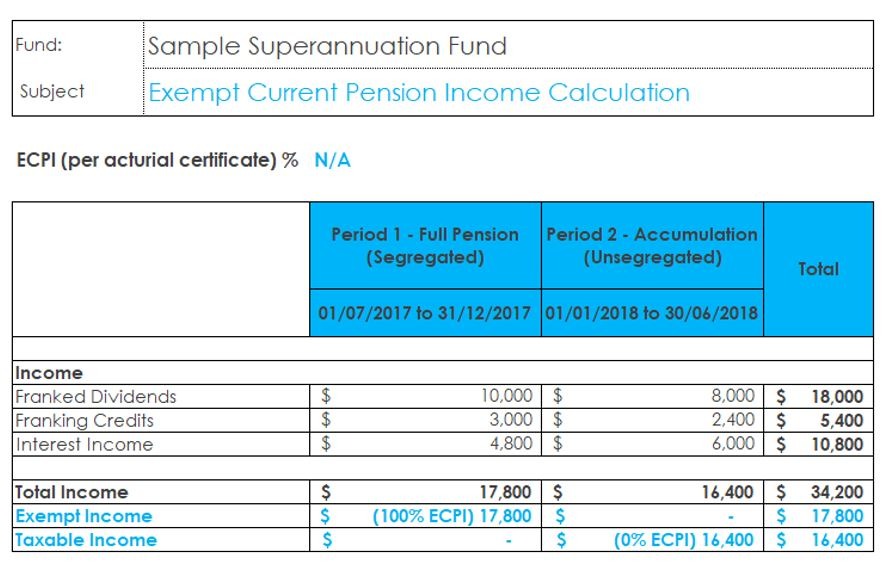

What should also be considered, is that in some circumstances an actuarial certificate may not be required, even though the fund may move between segregated and unsegregated, specifically, where a fund is segregated (100% pension phase) and moved to unsegregated with 100% of the fund in accumulation phase. In this example, 100% ECPI can be claimed for the period the fund was segregated and no ECPI will be eligible to be claimed when the fund is in 100% accumulation phase.

In the above example, because in each period is either 100% pension phase or 100% accumulation phase, no actuarial certificate would be required to be obtained. The fund will receive a 100% ECPI exemption for all income earned in the period the fund was segregated (100% pension). In the period the fund was unsegregated (100% accumulation), it will pay tax on all earnings at 15%.

The below example shows how ECPI would be calculated based on the above example:

Strategy to Avoid Having Multiple Periods

If you feel as though the old way of doing things was easier, rather than having to calculate income for multiple periods, it is still possible to do so.

In order for the fund to be deemed unsegregated for the full financial year, it must have an accumulation account. Therefore, you could potentially leave a small balance of $10 in accumulation phase for one member. Providing the balance remained active for the full financial year, an actuary certificate would need to be obtained and applied to the fund’s income for the full financial year. Because the accumulation balance will represent an immaterial amount, the actuary percentage should be very close to 100%.

Disregarded Small Fund Assets

From 1 July 2017, a fund will not be able to use the segregated method in a particular income year if it is considered a ‘disregarded small fund asset’.

An SMSF is considered a disregarded small fund asset where:

A fund member has a total superannuation balance over $1.6 million immediately before the start of the relevant income year

That member is receiving a retirement phase income stream from any source including the SMSF or another super provider

Any fund that is a disregarded small fund asset must use the unsegregated method to claim ECPI, which therefore means obtaining an actuarial certificate in order to be able to claim ECPI.

NOTE – Total superannuation balance includes not just the balance in the SMSF but all superannuation in every fund to which the member belongs.

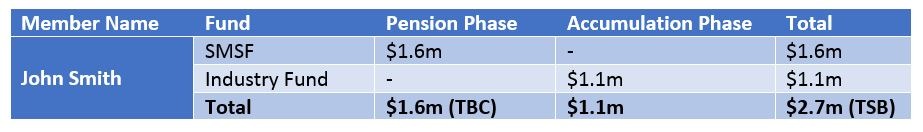

Consider the following example:

On 1 July 2017, John Smith has an ABP in his SMSF with a balance of $1.6m at 30 June 2017. John also has an industry fund with $1.1m in accumulation phase.

Because John has a Total Superannuation Balance (TSB) of $2.7m (exceeding the $1.6m test), in addition to a pension account in retirement phase at 30 June of the previous year (i.e. 30 June 2017) and that pension continues for the 2018 financial year, John’s SMSF is considered a Disregarded Small Fund Asset.

John’s SMSF MUST obtain an actuary certificate and claim ECPI using the unsegregated method. The fund is prohibited from using the segregated method.

In this situation the actuarial certificate will be 100%.

We do not believe this type of situation will affect many SMSF’s. Generally, a fund with over $1.6m will have a small accumulation balance.

If you have a SMSF in this situation, it may be worth considering retaining a small accumulation account within the fund (either by making a contribution or commuting a small amount of a member’s pension). This will avoid the fund from being considered a disregarded small fund asset.

Related Posts

- 2022-23 October Federal Budget SMSF Recap ( October 26, 2022 )

- Downsizer contributions; the scheme helping retirees bolster their super balance ( April 13, 2022 )

- Conditions of Release ( February 28, 2022 )

- The age-old debate; Corporate or Individual trustees ( February 4, 2022 )

- Pink Diamonds: Collectable or Precious Metal? ( November 15, 2021 )

- Let’s Talk Property Valuations ( September 10, 2021 )

- How to invest in Cryptocurrency for your SMSF – The right way ( August 16, 2021 )

- How to get SuperStream ready! ( August 6, 2021 )