Actuary Post CGT Relief – Required or Not?

With the super reforms and transfer balance caps now in place, consideration for SMSF’s and the planning and structure of members accounts is now at its utmost importance. In our blog CGT Relief, the ability to utilise CGT relief can alter the structure of a fund and where an actuarial certificate is required to calculate the exempt current pension income (ECPI).

Pre-Reforms

SMSF’s are classed as either segregated or unsegregated funds. Segregated funds do not require an actuarial certificate as the funds’ assets are allocated to either an accumulation or pension pool. Unsegregated funds have always been required to obtain an actuarial certificate to determine the percentage of income that is exempt from tax where the fund has both accumulation and pension accounts.

| SMSF Classification | Actuary required? |

| Unsegregated – both pension & accumulation accounts in the fund | Yes |

| Segregated – 100% pension phase; or – 100% accumulation phase; or – segregated assets | No |

Note: Funds in 100% accumulation clearly don’t require an actuary certificate where the assets are not segregated in the accounts.

Post Reforms

At 1 July 2017, there are some important changes that may affect when and how you apply for an actuarial certificate.

A “Personal Transfer Balance Cap” now limits a member to $1.6m in pension phase, and remain in the tax-free environment. Where the accumulitive pension balances for an individual exceeds their transfer balance cap , the members will be required to remove the excess. This can be done by commuting amounts from one or more pension accounts to accumulation phase before 1 July 2017, or by withdrawing the excess as a pension payment.

When applying for actuarial certificates in scenarios like this, it is important that all transactions between member accounts are correctly recorded and shown on the application form provided by the actuary provider.

Funds that are considered segregated and wish to utilise CGT relief using the segregated method cannot transfer part of an asset to accumulation phase. It must be the full value of the asset. On the face of it, the transfer of the asset to accumulation phase could have you thinking, “is this fund now an unsegregated fund?” The answer is no. As the whole value of the asset has been commuted, this asset is allocated to the accumulation account and every other asset in the fund is allocated to the pension balance, thus the fund is still segregated and therefore no actuarial certificate is required.

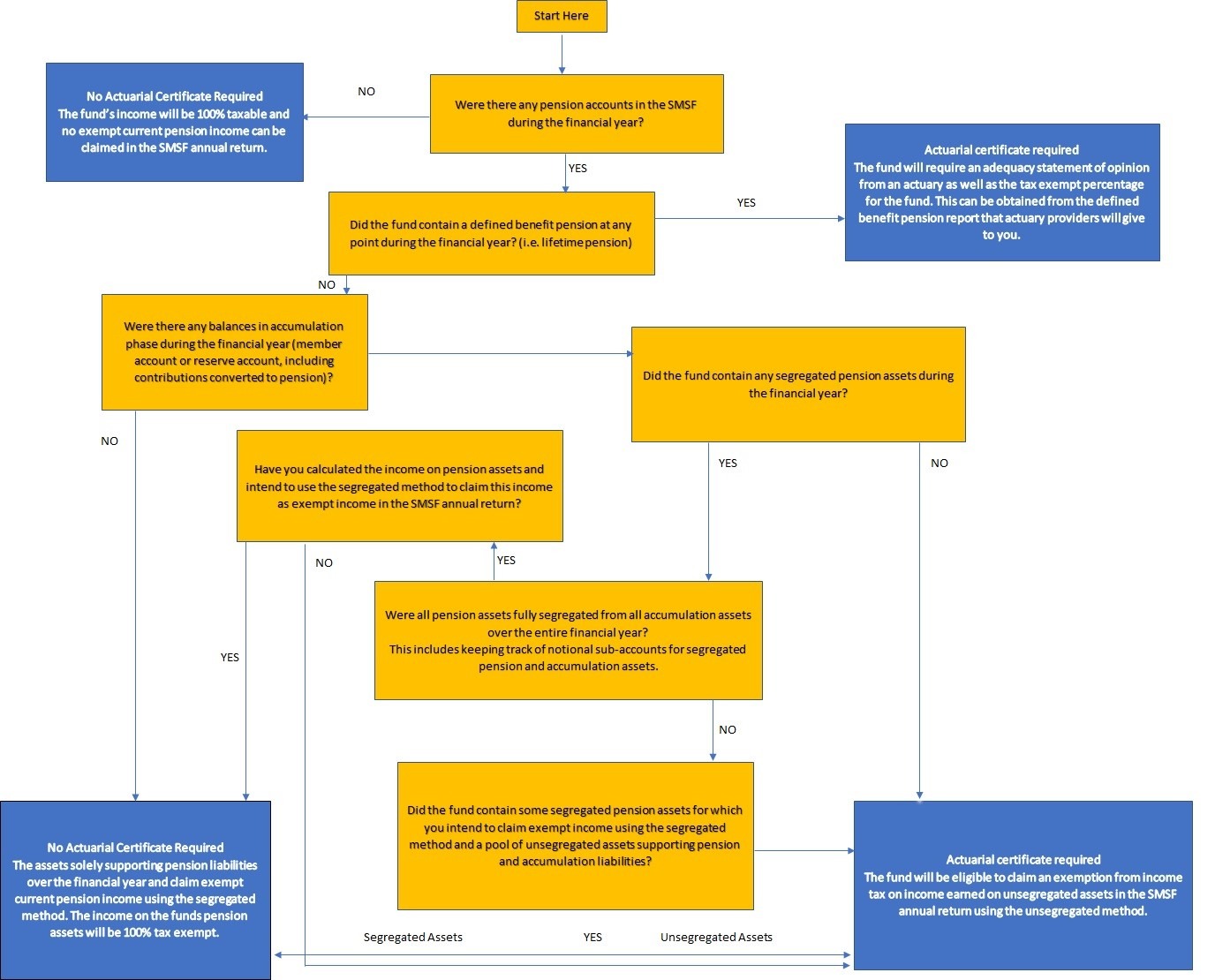

Refer to the below diagram (prepared by Accurium) for a guide on when an actuarial certificate is required from 30 June 2017 (ie. Lodgement of the 2017 SMSF Return):

Another area of focus from the changes introduced relates to Transition-to-Retirement Income Streams (TRIS). From 1 July 2017, a TRIS will no longer be considered in ‘retirement phase’ and eligible for a tax exemption on earnings. Instead, earnings from TRIS’s will be taxed at 15%. From an actuary perspective, a single member fund with an accumulation account & TRIS income stream will have no tax-exempt income and therefore not require an actuary certificate to be obtained.

Related Posts

- 2022-23 October Federal Budget SMSF Recap ( October 26, 2022 )

- Downsizer contributions; the scheme helping retirees bolster their super balance ( April 13, 2022 )

- Conditions of Release ( February 28, 2022 )

- The age-old debate; Corporate or Individual trustees ( February 4, 2022 )

- Pink Diamonds: Collectable or Precious Metal? ( November 15, 2021 )

- Let’s Talk Property Valuations ( September 10, 2021 )

- How to invest in Cryptocurrency for your SMSF – The right way ( August 16, 2021 )

- How to get SuperStream ready! ( August 6, 2021 )