Guide to Determine who is a Related Party

It is important to understand who a related party is of a Self-managed Super Fund (SMSF’s) as there are several guidelines around the acquisition of certain assets and the size of related party investments an SMSF can make (specifically In-House asset thresholds). Related party acquisitions and investments are the most commonly breached areas of the SMSF regime which is why this area is of great concerns to the ATO. The ATO is committed in maintaining governance around related parties of a fund being prevented from obtaining a present-day benefit from its SMSF investments.

Related party

The definition of a “related party” is not restricted by bloodline or to individuals; it is in fact, much more far-reaching than that. Section 10 of the SIS Act stipulates a related party to be any of the following:

- a member of the fund

- a standard employer-sponsor of the fund

- a Part 8 associate of an entity referred to in (a) or (b)

Member

A “member” of the fund is simply a person who receives a pension from the fund or a person who has deferred their entitlement to receive a benefit from the fund.

Standard Employer Sponsor

A common question we receive on the topic of ‘Related Party’ and ‘Employer Sponsors’ is the following:

“Is my employer, who regularly contributes into my fund automatically considered a standard employer sponsor?” Fair question as fundamentally all SMSF’s have an employer sponsor.

The answer is NO!

The difference between an employer sponsor and a standard employer sponsor is that a standard employer contributes to a fund for the benefit of a member, identical to that of a normal employer sponsor, but the employer is under an arrangement with the member of the fund. This type of arrangement is unlikely to be in modern trust deeds, nevertheless all deeds should be checked to ensure that an employer isn’t considered a standard employer sponsor.

Part 8 associate of an individual

The “Part 8” originates from the Part 8 of the SIS Act which deals with in-house asset rules and regulations. Part 8 associates are listed from s70(B) to s70(E) of the SIS Act but to simply things, we are going to focus on s70(B) which covers the group of people who are classed as a Part 8 associates to a member of an SMSF. A Part 8 associate of a member is:

- A relative to the member

- Other members of the SMSF

- If the fund is a single member SMSF, any other trustee, or director of a corporate trustee

- A business partner to the SMSF

- Any spouse or child of the business partner

- A trustee of a trust where the member controls the trust

- A company that is sufficiently influenced by, or in which a majority voting interest is held by, the member or any other Part 8 associate of the member

As you can see, the definition is long, complex and tangled but by breaking it down into sections we can make it less complicated.

Relative

The SIS Act provides two different definitions of a relative. One specific to who can become a member and the other for related party purposes.

A relative in relation to a related party is defined in s10(1) as:

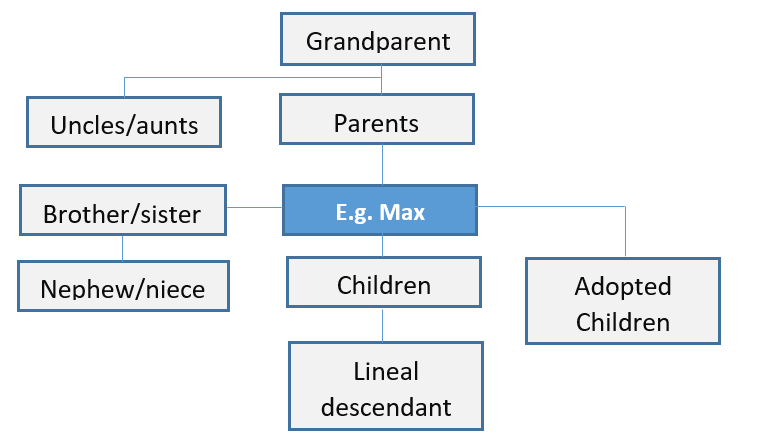

- a parent, grandparent, brother, sister, uncle, aunt, nephew, niece, lineal descendant or adopted child of the individual or of his or her spouse;

- a spouse of the member or of any other individual referred to above

I will share the exercise we like to use to determine who a relative is. You cannot go wrong if you implement the following steps:

- List all people shown in the diagram above with Max in the middle

- Replicate the above diagram, replacing Max’s name with his spouse, eg. Jenny. Then, list all the people that comes from her diagram

- Combine both lists then add the spouse of all people on the list

- Everyone on the list are determined a relative

It’s easy to see how large this network can become. The most obvious omission from the relative definition is that of a cousin.

Business Partner

A partnership is defined under the income tax law which exists when two or more entities are carrying on a business or in receipt of ordinary income or statuary income jointly.

It can be difficult to determine the difference between a partnership and a joint venture at times. Consider the following example: If two farmers came together to sow a paddock of wheat, what do they do with the wheat?

If together the farmers harvest the crop and sell to a wheat buyer, then split the earnings between them (agreed percentages), they will be most likely regarded as being in partnership as they are in receipt of income jointly.

If the farmers harvest the crop together then one decides to re-sow their wheat and the other uses the wheat personally then this arrangement is most likely to be a joint venture as there is no receipt of income jointly.

The key consideration if a partnership exists, is to then determine clearly what entity is in partnership with the individual member. The point here is that the INDIVIDUAL MEMBER must be the legal partner. When this is the case, the other entity becomes a Part 8 Associate of that member.

Spouse

According to the ATO, a spouse includes:

- another person (whether of the same sex or a different sex) with whom the person is in a relationship that is registered under a law of a State or Territory

- another person who, although not legally married to the person, lives with the person on a genuine domestic basis in a relationship as a couple

Control of a Trust

A trustee or trustees of a trust, in which the member controls that trust is classed as a Part 8 associate of that member. A member of the fund will be considered to control a trust where the member and/or their part 8 associates are:

- Entitled to a fixed entitlement of more than 50% of the capital of the trust; or

- Able or accustomed (formally or informally) to direct the trustees to act in accordance with their directions; or

- Able to appoint or remove trustees

Control of a company

Equal to a trust, a company which the member controls is categorized as a Part 8 associate of that member. To have control of a company, one of the two must be applicable:

- A company is sufficiently Influenced by the member and/or a Part 8 associate of that member

- This comes about if the company, or a majority of its directors, are accustomed, obliged or expected to act in accordance with directions, instructions or wishes of the member and/or Part 8 associate or the member

- The member and/or a Part 8 associate of that member have a majority voting interest in a company

- Someone is deemed to have a majority voting interest in a company if they are in a position to cast, control the casting vote, of more than 50% of the maximum number of votes at the annual general meeting of that company

Once an entity or individual has been identified as a related party, you are then well placed to consider the impact of whether the related party, in conjunction with investments of a SMSF, fall within the In-House Asset rules and s71 exemptions for acquiring assets.

For any technical questions, or to find out about how our services can support your business, call our team on 03-5226 3599 or email [email protected]. Also, follow us on social media to keep up to date with our latest posts and blogs.

Related Posts

- 2022-23 October Federal Budget SMSF Recap ( October 26, 2022 )

- Downsizer contributions; the scheme helping retirees bolster their super balance ( April 13, 2022 )

- Conditions of Release ( February 28, 2022 )

- The age-old debate; Corporate or Individual trustees ( February 4, 2022 )

- Pink Diamonds: Collectable or Precious Metal? ( November 15, 2021 )

- Let’s Talk Property Valuations ( September 10, 2021 )

- How to invest in Cryptocurrency for your SMSF – The right way ( August 16, 2021 )

- How to get SuperStream ready! ( August 6, 2021 )