Wouldn’t it be great if you understood how an auditor arrived at the conclusion of having to notify the ATO of a fund breach? Today, we open up the curtains and show you the guidelines that all auditors MUST adhere to.

The following tests establish what contraventions an auditor must report to the ATO:

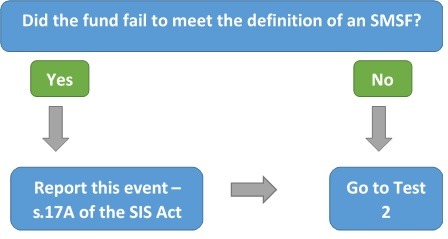

Test 1: Fund Definition Test

Examples that would result in a fund failing to meet the definition of an SMSF include:

The fund has more than 5 members

An employee and their employer are members of the same SMSF and are not relatives

The fund only appointed 1 individual trustee

One of the fund’s members are considered disqualified

There is a breach of the residency test

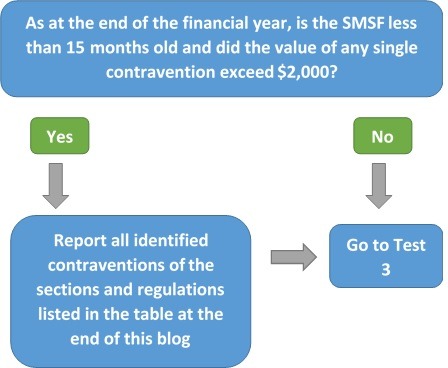

Test 2: New Fund Test

It could be very easy for a fund to mistakenly have a $2,000 breach. Here are some of the common breaches we see for first year funds:

SMSF pays for a member’s personal expense(s)

SMSF loans money to a related party entity

Member mistakenly deposits money into the SMSF bank account (doesn’t want to treat as a contribution)

SMSF’s investment are not held under the correct trustee name

It is very important your new trustees are aware of the rules, and particularly in the first 15 months of the funds establishment!

The 15 months is measured from the establishment date of the fund. A fund is generally established on the date it first holds any assets.

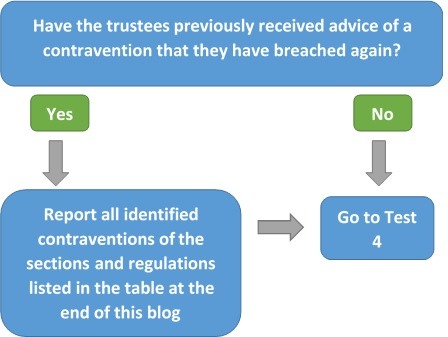

Test 3: Trustee Behaviour Test

A contravention must be reported to the ATO where the trustees have previously received advice of a breach within the fund and, after receiving this advice, they breach the same section or regulation in the subsequent year’s audit. For example, the trustees may have received a management letter in the prior year’s audit, and subsequently been in breach of the same section or regulation in the next year’s audit.

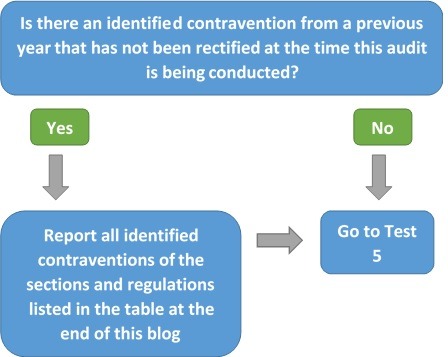

Test 4: Trustee Behaviour Test

Where a fund had a breach in a previous year’s audit, if that breach remains outstanding when completing the following year’s audit, a contravention report must be issued.

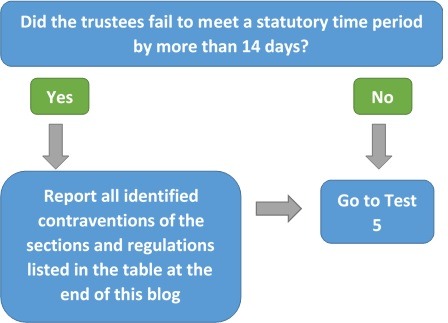

Test 5: Trustee Behaviour Test

A statutory time period refers to periods prescribed in the SIS Act and SIS Regulations. Examples of this include:

A fund will be in breach of section 35C(2) of the SIS Act if the trustees fail to provide the auditor with requested documents within 14 days of the request being made

If a trustee declaration is not signed within 21 days of the member becoming a trustee (or director of a corporate trustee) of an SMSF, the fund will have a breach of section 104A of the SIS Act

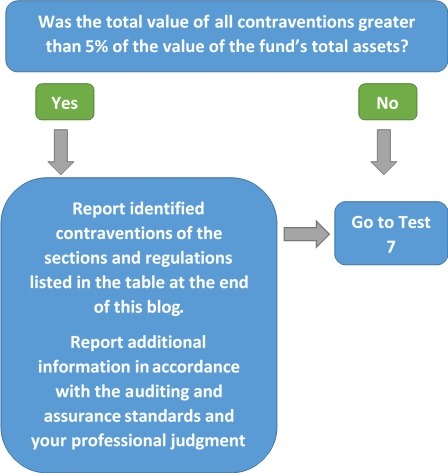

Test 6: Financial Threshold Test

This is one of the most common tests funds seem to fail. Some of the most common breaches we see in relation to this test include:

The fund loans to a member or relative to which the amount loaned represents more than 5% of the fund’s assets

The fund has an in-house asset that exceeds 5% of the fund’s assets

NOTE – A fund is allowed to have an in-house asset of up to 5% of the fund’s assets, therefore in order to fail this test, the in-house asset must represent more than 10% of the fund’s asset

Example #1:

Fund Assets – $1m

Loan to Related Entity – $90k

Fund IHA Threshold – $50k ($1m x 5%)

IHA Breach Amount – $40k ($90k – $50k)

RESULT – The fund would not fail test 6 as the value of the in-house asset that is prohibited (i.e. the amount over 5% of the fund’s assets) represents 4% of the total assets of the fund which is less than the 5% reportable threshold.

(NB: important not to confuse the In-House Asset threshold of 5% with ‘breach threshold’ of 5% as they are totally unrelated.

Example #2:

If a fund has multiple breaches, we must combine the total value of all breaches as they are not assessed separately.

Taking into account our breach from example 1, if the fund also breached section 66 (acquisition of assets from a related party) due to a $30,000 acquisition , the fund would be assessed as follows:Fund Assets – $1m

IHA Breach amount – $40k (4% of fund)

Acquisition Breach – $30k (3% of fund)

Total breach amount – $70k (7% of fund)

Both breaches individually represent less than 5% of the fund’s assets, however, due to the fact that both breaches occurred in the same financial year, the amounts must be combined.

Because the combined breaches represent over 5% of the fund’s assets (7% minus 5%, equals 2% over the reportable threshold), both breaches MUST be reported.

Both breaches individually represent less than 5% of the fund’s assets, however, due to the fact that both breaches occurred in the same financial year, the amounts must be combined.

Because the combined breaches represent over 5% of the fund’s assets (7% minus 5%, equals 2% over the reportable threshold), both breaches MUST be reported.

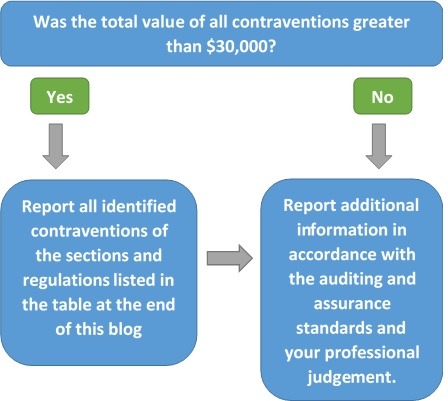

Test 7: Financial Threshold Test

Where a fund has a breach and passes test 6, there is a chance they will be caught under this test.

For example, if we look at our in-house asset case in the prior test example, the fund would fail to pass this test because the reportable in-house asset amount exceeds $30k (reported at $40k).

Further information regarding the auditor reporting guidelines can be found here.

Professional Judgement

Auditors are also encouraged to report contraventions and other information they believe will help the ATO perform their function as the regulator of SMSFs. Where auditors are unsure on whether to use professional judgement, they are encouraged to refer to the auditing and assurance standards.

Guidance Statement GS 009 Auditing Self Managed Superannuation Funds was issued by the Auditing and Assurance Standards Board in August 2011 to assist SMSF auditors in fulfilling the objectives of the audit. It includes explanatory details and suggested procedures on specific matters for the purposes of understanding and complying with auditing and assurance standards.

The auditor can use this Guidance Statement to assist with making professional judgements.

Click here to view it!

The table below summarises the list of reportable sections and regulations used for the above tests.

Section or Regulation | Section or Regulation Title | Does a Statutory Time Period Apply? |

S.17A | SMSF definition | No |

S35C(2) | Trustee to provide documents to the auditor | Yes. Trustees must ensure that requested relevant documents are given to the auditor within 14 days of the request being made |

S52(2)(d) or R4.09A1 | Separation of assets | No |

S62 | Sole purpose test | No |

S65 | Lending or providing financial assistance to members or their relatives | No |

S66 | Acquisition of assets from related parties | No |

S67 | Borrowing by the fund | Yes. For borrowing exceptions only. A temporary borrowing to pay beneficiaries or to make a super surcharge payment must not exceed 90 days.A temporary borrowing to cover settlement of securities transactions must not exceed seven days. |

S82 | In-house assets – exceeding in-house assets ratio | Yes. Market value ratio for the 2000–01 year of income and later years of income. If it exceeds 5%, the trustee must prepare and carry out a written plan to reduce the market value ratio to 5% or less before the end of the following year of income. |

S83 | In-house assets – prohibition on further acquisition | No |

S84 | In-house asset rules must be complied with | No |

S85 | In-house assets – prohibition of avoidance schemes | No |

S103 | Minutes and records | Yes. Trustees must retain minutes of all meetings and records of all decisions for at least 10 years. |

S104A | Trustee declaration | Yes. A trustee declaration in the approved form must be signed within 21 days of becoming a trustee (or a director of a corporate trustee) of an SMSF. |

S109 | Investments to be maintained on an arm’s length basis | No |

S126K | Disqualified persons not to be trustees | Yes. Trustees must immediately tell us in writing if a trustee is or becomes a disqualified person. |

R4.09 | Investment strategy | No |

R5.08 | Minimum benefits | No |

R6.17 | Restriction on payment of benefits | No |

R7.04 | Acceptance of contributions | Yes. Returning contributions to members within 30 days – for example, where no TFN is quoted. |

R8.02B2 | Valuation of assets | No |

R13.14 | Charges over assets of the fund | No |

R13.18AA | Investment in collectables and personal use assets | Yes. If the fund held an investment in a collectable or personal use asset before 1 July 2011, it has until 1 July 2016 to comply with the new rules associated with holding, storing and insuring these investments.Collectables and personal-use assets need to be insured within seven days of the date of acquisition by the SMSF. |

1: R4.09A commenced on the 07/08/2012 | ||

Related Posts

- 2022-23 October Federal Budget SMSF Recap ( October 26, 2022 )

- Downsizer contributions; the scheme helping retirees bolster their super balance ( April 13, 2022 )

- Conditions of Release ( February 28, 2022 )

- The age-old debate; Corporate or Individual trustees ( February 4, 2022 )

- Pink Diamonds: Collectable or Precious Metal? ( November 15, 2021 )

- Let’s Talk Property Valuations ( September 10, 2021 )

- How to invest in Cryptocurrency for your SMSF – The right way ( August 16, 2021 )

- How to get SuperStream ready! ( August 6, 2021 )