Technical

September 8, 2017

Auditor Reporting Guidelines

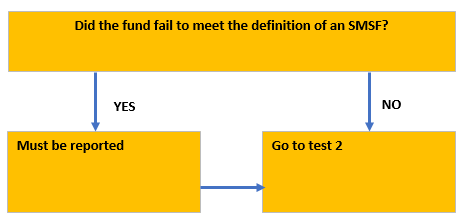

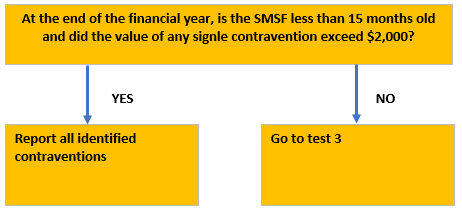

One area of discussion that can often be rather unclear is, “when are auditors required to notify the ATO of a breach in the SIS Act?” Firstly, the auditor needs to identify a contravention. This can be black and white or conversely require plenty of correspondence to form the basis of opinion.

Once a contravention has been identified, testing is applied to determine if the breach is reportable to the ATO or simply a management letter addressed to the trustees. The ATO guidelines have a step-by-step test for reporting criteria, as below:

Test 1: Fund definition test Test 2: New fund test

Test 3: Trustee behaviour test

Test 4: Trustee behaviour test

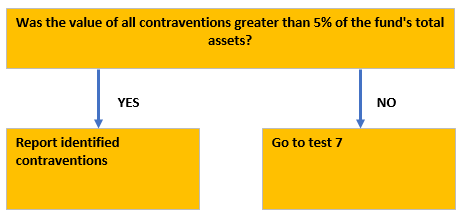

Test 5: Trustee behaviour test Test 6: Financial threshold test

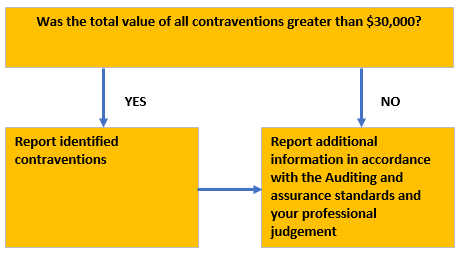

Test 7: Financial threshold test

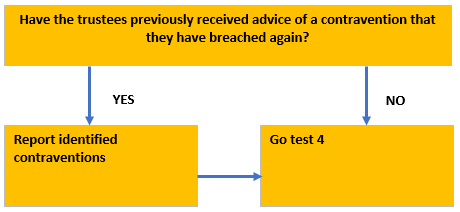

Here is a practical example of how the reporting criteria can be used:

An SMSF has $1,000,000 of gross assets. It loans $35,000 to a member of the fund.

Loaning money to a member of an SMSF is a breach in s.65 of the SIS Act.

Upon review by the auditor, the fund has passed the first 5 tests as part of the reporting criteria.

Test 6: Was the total value of all contraventions greater than 5% of fund’s total assets?

Auditors are required to report any contravention if in the normal course of conducting the audit, they form the opinion that the contravention has occurred either:

during the year of income being audited, or

before or after the year of income being audited

For example, if a contravention is identified in 2016/17 and the auditors are satisfied the contravention has been rectified, however, it wasn’t rectified until 2017/18 then a report must be lodged for both 2016/17 & 2017/18 as rectified.

Related Posts

- 2022-23 October Federal Budget SMSF Recap ( October 26, 2022 )

- Downsizer contributions; the scheme helping retirees bolster their super balance ( April 13, 2022 )

- Conditions of Release ( February 28, 2022 )

- The age-old debate; Corporate or Individual trustees ( February 4, 2022 )

- Pink Diamonds: Collectable or Precious Metal? ( November 15, 2021 )

- Let’s Talk Property Valuations ( September 10, 2021 )

- How to invest in Cryptocurrency for your SMSF – The right way ( August 16, 2021 )

- How to get SuperStream ready! ( August 6, 2021 )